貝萊德(BlackRock)是全球規模最大的資產管理公司之一,總部位於美國紐約。它於1988年創立,從最初的八人團隊發展至今,管理的資產規模已達到數兆美元,為全球各地的機構和零售客戶提供廣泛的投資管理、風險管理及顧問服務。貝萊德的業務範圍涵蓋多種資產類別,包括股票、固定收益、另類投資以及其知名的iShares安碩交易所買賣基金(ETF)系列。貝萊德在全球設有多個辦事處,致力於協助客戶實現長期財務目標,並積極參與全球市場的永續投資和能源轉型等重要議題。

iShares ETF是什麼

❗iShares 安碩是全球最大的資產管理公司貝萊德(BlackRock)旗下的交易所買賣基金(ETF)品牌❗。簡單來說,它提供種類繁多的 ETF 產品,讓投資人能夠以相對低的成本和便利的方式,投資於各式各樣的市場和資產。

ETF 的核心概念是「指數型基金」,但它的最大特色在於像股票一樣在證券交易所掛牌交易。這意味著投資人可以在交易時間內隨時買賣 iShares ETF,其價格會像股票一樣隨著市場供需即時變動。

iShares ETF基金排名

iShares 旗下有數百檔 ETF,其績效表現會因投資標的、市場環境和時間點而有巨大差異。以下是iShares ETF基金排名以5年 (平均年回報率)

| 代號 | ETF名稱 | 5年 (平均年回報率) |

| SMIN | iShares MSCI India Small-Cap ETF | 26.23% |

| EUFN | iShares MSCI Europe Financials ETF | 25.42% |

| IAI | iShares U.S. Broker-Dealers & Securities Exchanges ETF | 23.86% |

| IEO | iShares U.S. Oil & Gas Exploration & Production ETF | 23.85% |

| IAK | iShares U.S. Insurance ETF | 23.26% |

| EWI | iShares MSCI Italy ETF | 22.07% |

| SOXX | iShares Semiconductor ETF | 21.46% |

| EWO | iShares MSCI Austria ETF | 20.96% |

| IYW | iShares U.S. Technology ETF | 20.91% |

| IXG | iShares Global Financials ETF | 20.50% |

| FOVL | iShares Focused Value Factor ETF | 20.38% |

| IETC | iShares U.S. Tech Independence Focused ETF | 20.33% |

| IYE | iShares U.S. Energy ETF | 20.28% |

| EWP | iShares MSCI Spain ETF | 20.23% |

| GARP | iShares MSCI USA Quality GARP ETF | 19.77% |

| IXN | iShares Global Tech ETF | 19.04% |

| IGM | iShares Expanded Tech Sector ETF | 19.01% |

| IYF | iShares U.S. Financials ETF | 18.91% |

| IWY | iShares Russell Top 200 Growth ETF | 18.91% |

| IXC | iShares Global Energy ETF | 18.64% |

| IFRA | iShares U.S. Infrastructure ETF | 18.60% |

| ITA | iShares U.S. Aerospace & Defense ETF | 18.34% |

| IYG | iShares U.S. Financial Services ETF | 18.28% |

| HEWJ | iShares Currency Hedged MSCI Japan ETF | 18.11% |

| IGE | iShares North American Natural Resources ETF | 17.97% |

| EPOL | iShares MSCI Poland ETF | 17.95% |

| FILL | iShares MSCI Global Energy Producers ETF | 17.88% |

| ITB | iShares U.S. Home Construction ETF | 17.82% |

| IWF | iShares Russell 1000 Growth ETF | 17.79% |

| EWW | iShares MSCI Mexico ETF | 17.73% |

| DYNF | iShares U.S. Equity Factor Rotation Active ETF | 17.70% |

| OEF | iShares S&P 100 ETF | 17.46% |

| UAE | iShares MSCI UAE ETF | 17.36% |

| EXI | iShares Global Industrials ETF | 17.35% |

| INDA | iShares MSCI India ETF | 17.22% |

| GSG | iShares S&P GSCI Commodity-Indexed Trust | 17.16% |

| HEZU | iShares Currency Hedged MSCI Eurozone ETF | 17.07% |

| IOO | iShares Global 100 ETF | 17.05% |

| IWL | iShares Russell Top 200 ETF | 16.83% |

| IVW | iShares S&P 500 Growth ETF | 16.75% |

| LRGF | iShares US Equity Factor ETF | 16.71% |

| INDY | iShares India 50 ETF | 16.70% |

| IUSG | iShares Core S&P U.S. Growth ETF | 16.67% |

| IVV | iShares Core S&P 500 ETF | 16.37% |

| IVLU | iShares MSCI Intl Value Factor ETF | 16.29% |

| SUSL | iShares ESG MSCI USA Leaders ETF | 16.24% |

| IWB | iShares Russell 1000 ETF | 15.99% |

| IEZ | iShares U.S. Oil Equipment & Services ETF | 15.99% |

| DIVB | iShares Core Dividend ETF | 15.89% |

| ILCB | iShares Morningstar U.S. Equity ETF | 15.84% |

| EWT | iShares MSCI Taiwan ETF | 15.83% |

| IYY | iShares Dow Jones U.S. ETF | 15.75% |

| ILCG | iShares Morningstar Growth ETF | 15.75% |

| ITOT | iShares Core S&P Total U.S. Stock Market ETF | 15.71% |

| IMCV | iShares Morningstar Mid-Cap Value ETF | 15.71% |

| DSI | iShares ESG MSCI KLD 400 ETF | 15.64% |

| IWV | iShares Russell 3000 ETF | 15.64% |

| EFV | iShares MSCI EAFE Value ETF | 15.62% |

| EZU | iShares MSCI Eurozone ETF | 15.54% |

| ESGU | iShares ESG Aware MSCI USA ETF | 15.54% |

| IJJ | iShares S&P Mid-Cap 400 Value ETF | 15.47% |

| EPU | iShares MSCI Peru and Global Exposure ETF | 15.46% |

| IYJ | iShares U.S. Industrials ETF | 15.46% |

| SUSA | iShares MSCI USA ESG Select ETF | 15.38% |

| TOK | iShares MSCI Kokusai ETF | 15.30% |

| SMLF | iShares U.S. Small‑Cap Equity Factor ETF | 15.27% |

| EWQ | iShares MSCI France ETF | 15.27% |

| PICK | iShares MSCI Global Metals & Mining Producers ETF | 15.11% |

| HEFA | iShares Currency Hedged MSCI EAFE ETF | 15.11% |

| QUAL | iShares MSCI USA Quality Factor ETF | 15.08% |

| EWC | iShares MSCI Canada ETF | 15.00% |

| URTH | iShares MSCI World ETF | 14.91% |

| TECB | iShares U.S. Tech Breakthrough Multisector ETF | 14.88% |

| ISCV | iShares Morningstar Small Cap Value ETF | 14.84% |

| IUSV | iShares Core S&P U.S. Value ETF | 14.81% |

| IGV | iShares Expanded Tech-Software Sector ETF | 14.78% |

| DVY | iShares Select Dividend ETF | 14.70% |

| IVE | iShares S&P 500 Value ETF | 14.54% |

| EIRL | iShares MSCI Ireland ETF | 14.53% |

| EWG | iShares MSCI Germany ETF | 14.44% |

| MTUM | iShares MSCI USA Momentum Factor ETF | 14.20% |

| IYK | iShares U.S. Consumer Staples ETF | 14.19% |

| IDV | iShares International Select Dividend ETF | 14.10% |

| SIZE | iShares MSCI USA Size Factor ETF | 14.08% |

| CRBN | iShares MSCI ACWI Low Carbon Target ETF | 14.05% |

| EWN | iShares MSCI Netherlands ETF | 14.01% |

| EEMS | iShares MSCI Emerging Markets Small-Cap ETF | 14.00% |

| IEV | iShares Europe ETF | 13.94% |

| GLOF | iShares Global Equity Factor ETF | 13.94% |

| ACWI | iShares MSCI ACWI ETF | 13.89% |

| IWS | iShares Russell Mid-Cap Value ETF | 13.88% |

| DGRO | iShares Core Dividend Growth ETF | 13.79% |

| IEDI | iShares U.S. Consumer Focused ETF | 13.78% |

| EUSA | iShares MSCI USA Equal Weighted ETF | 13.76% |

| IEUR | iShares Core MSCI Europe ETF | 13.76% |

| ILCV | iShares Morningstar Value ETF | 13.68% |

| IMCB | iShares Morningstar Mid-Cap ETF | 13.63% |

| EWU | iShares MSCI United Kingdom ETF | 13.56% |

| IJH | iShares Core S&P Mid-Cap ETF | 13.54% |

| IWD | iShares Russell 1000 Value ETF | 13.54% |

| VEGI | iShares MSCI Agriculture Producers ETF | 13.50% |

| IAU | iShares Gold Trust | 13.48% |

| SLV | iShares Silver Trust | 13.48% |

| COMT | iShares U.S. ETF Trust iShares GSCI Commodity Dynamic Roll Strategy ETF | 13.44% |

| IXP | iShares Global Comm Services ETF | 13.37% |

| IWR | iShares Russell Midcap ETF | 13.31% |

| IWX | iShares Russell Top 200 Value ETF | 13.29% |

| IYC | iShares U.S. Consumer Discretionary ETF | 13.25% |

| EZA | iShares MSCI South Africa ETF | 13.19% |

| EWJV | iShares MSCI Japan Value ETF | 13.15% |

| HAWX | iShares Currency Hedged MSCI ACWI ex U.S. ETF | 13.13% |

| HSCZ | iShares Currency Hedged MSCI EAFE Small Cap ETF | 13.08% |

| IYT | iShares US Transportation ETF | 13.06% |

| IGRO | iShares International Dividend Growth ETF | 12.95% |

| EWD | iShares MSCI Sweden ETF | 12.93% |

| IJS | iShares S&P Small-Cap 600 Value ETF | 12.85% |

| IGF | iShares Global Infrastructure ETF | 12.80% |

| ILF | iShares Latin America 40 ETF | 12.80% |

| INTF | iShares International Equity Factor ETF | 12.77% |

| IWP | iShares Russell Mid-Cap Growth ETF | 12.56% |

| ENOR | iShares MSCI Norway ETF | 12.53% |

| IWN | iShares Russell 2000 Value ETF | 12.52% |

| CMDY | iShares Bloomberg Roll Select Commodity Strategy ETF | 12.33% |

| ESML | iShares ESG Aware MSCI USA Small-Cap ETF | 12.32% |

| IHAK | iShares Cybersecurity & Tech ETF | 12.29% |

| IDEV | iShares Core MSCI International Developed Markets ETF | 12.27% |

| EWA | iShares MSCI-Australia ETF | 12.23% |

| IJR | iShares Core S&P Small-Cap ETF | 12.22% |

| RXI | iShares Global Consumer Discretionary ETF | 12.20% |

| EFA | iShares MSCI EAFE ETF | 12.20% |

| ESGD | iShares ESG Aware MSCI EAFE ETF | 12.07% |

| IEFA | iShares Core MSCI EAFE ETF | 12.00% |

| EWS | iShares MSCI Singapore ETF | 11.91% |

| EDEN | iShares MSCI Denmark ETF | 11.90% |

| IMCG | iShares Morningstar Mid-Cap Growth ETF | 11.86% |

| VLUE | iShares MSCI USA Value Factor ETF | 11.86% |

| SMMD | iShares Russell 2500 ETF | 11.70% |

| IAT | iShares U.S. Regional Banks ETF | 11.66% |

| IQLT | iShares MSCI Intl Quality Factor ETF | 11.52% |

| IYM | iShares U.S. Basic Materials ETF | 11.46% |

| TUR | iShares MSCI Turkey ETF | 11.37% |

| IJK | iShares S&P Mid-Cap 400 Growth ETF | 11.28% |

| HDV | iShares Core High Dividend ETF | 11.26% |

| IEUS | iShares MSCI Europe Small-Cap ETF | 11.23% |

| USMV | iShares MSCI USA Min Vol Factor ETF | 11.21% |

| ISCF | iShares International Small‑Cap Equity Factor ETF | 11.17% |

| MXI | iShares Global Materials ETF | 11.14% |

| IJT | iShares S&P Small-Cap 600 Growth ETF | 11.11% |

| AOA | iShares Core 80/20 Aggressive Allocation ETF | 11.10% |

| KSA | iShares MSCI Saudi Arabia ETF | 11.05% |

| IXUS | iShares Core MSCI Total International Stock ETF | 11.05% |

| EWK | iShares MSCI Belgium ETF | 11.04% |

| IMTM | iShares MSCI Intl Momentum Factor ETF | 11.00% |

| IDGT | iShares U.S. Digital Infrastructure and Real Estate ETF | 10.99% |

| IDU | iShares U.S. Utilities ETF | 10.93% |

| EIS | iShares MSCI Israel ETF | 10.86% |

| ACWX | iShares MSCI ACWI ex U.S. ETF | 10.80% |

| EMXC | iShares MSCI Emerging Markets ex China ETF | 10.75% |

| ISCB | iShares Morningstar Small-Cap ETF | 10.54% |

| JXI | iShares Global Utilities ETF | 10.46% |

| ECH | iShares MSCI Chile ETF | 10.21% |

| REZ | iShares Residential and Multisector Real Estate ETF | 10.11% |

| ICVT | iShares Convertible Bond ETF | 10.07% |

| IWM | iShares Russell 2000 ETF | 10.02% |

| EWL | iShares MSCI Switzerland ETF | 9.95% |

| SMMV | iShares MSCI USA Small-Cap Min Vol Factor ETF | 9.87% |

| DVYA | iShares Asia/Pacific Dividend ETF | 9.81% |

| USRT | iShares Core U.S. REIT ETF | 9.78% |

| EWZ | iShares MSCI Brazil ETF | 9.77% |

| EQLT | iShares MSCI Emerging Markets Quality Factor ETF | 9.72% |

| EMGF | iShares Emerging Markets Equity Factor ETF | 9.64% |

| EPP | iShares MSCI Pacific ex Japan ETF | 9.42% |

| SCZ | iShares MSCI EAFE Small-Cap ETF | 9.33% |

| IWC | iShares Micro-Cap ETF | 9.23% |

| WOOD | iShares Global Timber & Forestry ETF | 9.22% |

| RING | iShares MSCI Global Gold Miners ETF | 8.97% |

| IPAC | iShares Core MSCI Pacific ETF | 8.93% |

| XT | iShares Exponential Technologies ETF | 8.80% |

| ACWV | iShares MSCI Global Min Vol Factor ETF | 8.78% |

| EWUS | iShares MSCI United Kingdom Small-Cap ETF | 8.53% |

| JPXN | iShares JPX-Nikkei 400 ETF | 8.51% |

| EWJ | iShares MSCI Japan ETF | 8.48% |

| KXI | iShares Global Consumer Staples ETF | 8.36% |

| EFG | iShares MSCI EAFE Growth ETF | 8.30% |

| AOR | iShares Core 60/40 Balanced Allocation ETF | 8.25% |

| EFAV | iShares MSCI EAFE Min Vol Factor ETF | 8.17% |

| EFNL | iShares MSCI Finland ETF | 8.16% |

| IEMG | iShares Core MSCI Emerging Markets ETF | 8.09% |

| QAT | iShares MSCI Qatar ETF | 8.04% |

| HYGH | iShares Interest Rate Hedged High Yield Bond ETF | 8.04% |

| ICF | iShares Select U.S. REIT ETF | 7.72% |

| HEEM | iShares Currency Hedged MSCI Emerging Markets ETF | 7.67% |

| IHI | iShares U.S. Medical Devices ETF | 7.59% |

| IYR | iShares U.S. Real Estate ETF | 7.58% |

| REET | iShares Global REIT ETF | 7.49% |

| AIA | iShares Asia 50 ETF | 7.34% |

| ISCG | iShares Morningstar Small-Cap Growth ETF | 7.28% |

| IWO | iShares Russell 2000 Growth ETF | 7.26% |

| EWZS | iShares MSCI Brazil Small-Cap ETF | 7.22% |

| ARTY | iShares Future AI & Tech ETF | 7.17% |

| REM | iShares Mortgage Real Estate ETF | 7.06% |

| ESGE | iShares ESG Aware MSCI EM ETF | 6.89% |

| IGBH | iShares Interest Rate Hedged Long-Term Corporate Bond ETF | 6.80% |

| DVYE | iShares Emerging Markets Dividend ETF | 6.78% |

| EEMV | iShares MSCI Emerging Markets Min Vol Factor ETF | 6.73% |

| HYDB | iShares High Yield Systematic Bond ETF | 6.68% |

| EEM | iShares MSCI Emerging Markets ETF | 6.65% |

| EEMA | iShares MSCI Emerging Markets Asia ETF | 6.60% |

| IBHE | iShares iBonds 2025 Term High Yield & Income ETF | 6.39% |

| LDEM | iShares ESG MSCI EM Leaders ETF | 6.34% |

| SHYG | iShares 0-5 Year High Yield Corporate Bond ETF | 6.25% |

| IYH | iShares U.S. Healthcare ETF | 6.22% |

| SCJ | iShares MSCI Japan Small Cap ETF | 6.21% |

| FALN | iShares Fallen Angels USD Bond ETF | 6.19% |

| IDRV | iShares Self-driving EV & Tech ETF | 6.12% |

| EIDO | iShares MSCI Indonesia ETF | 6.04% |

| IHE | iShares U.S. Pharmaceuticals ETF | 6.02% |

| USHY | iShares Broad USD High Yield Corporate Bond ETF | 5.92% |

| AAXJ | iShares MSCI All Country Asia ex-Japan ETF | 5.91% |

| LQDH | iShares Interest Rate Hedged Corporate Bond ETF | 5.81% |

| IXJ | iShares Global Healthcare ETF | 5.76% |

| HYXU | iShares International High Yield Bond ETF | 5.40% |

| SDG | iShares MSCI Global Sustainable Development Goals ETF | 5.31% |

| AOM | iShares Core 40/60 Moderate Allocation ETF | 5.31% |

| SLVP | iShares MSCI Global Silver Miners ETF | 5.25% |

| GHYG | iShares US & Intl High Yield Corp Bond ETF | 5.24% |

| EMIF | iShares Emerging Markets Infrastructure ETF | 5.02% |

| EMHY | iShares J.P. Morgan EM High Yield Bond ETF | 4.87% |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF | 4.85% |

| HYXF | iShares ESG Advanced High Yield Corporate Bond ETF | 4.62% |

| IHF | iShares U.S. Healthcare Providers ETF | 4.37% |

| EWY | iShares MSCI South Korea ETF | 4.17% |

| EPHE | iShares MSCI Philippines ETF | 4.08% |

| IYLD | iShares Morningstar Multi-Asset Income ETF | 3.91% |

| AOK | iShares Core 30/70 Conservative Allocation ETF | 3.90% |

| STIP | iShares 0-5 Year TIPS Bond ETF | 3.78% |

| FLOT | iShares Floating Rate Bond ETF | 3.56% |

| LQDI | iShares Inflation Hedged Corporate Bond ETF | 3.49% |

| NEAR | iShares Short Duration Bond Active ETF | 3.41% |

| EWM | iShares MSCI Malaysia ETF | 3.39% |

| IYZ | iShares U.S. Telecommunications ETF | 3.33% |

| PFF | iShares Preferred & Income Securities ETF | 3.17% |

| BKF | iShares MSCI BIC ETF | 3.14% |

| ICSH | iShares Ultra Short Duration Bond Active ETF | 2.92% |

| ICLN | iShares Global Clean Energy ETF | 2.83% |

| TFLO | iShares Treasury Floating Rate Bond ETF | 2.80% |

| SHV | iShares Short Treasury Bond ETF | 2.50% |

| CEMB | iShares J.P. Morgan EM Corporate Bond ETF | 2.44% |

| IFGL | iShares International Developed Real Estate ETF | 2.20% |

| IGSB | iShares 1-5 Year Investment Grade Corporate Bond ETF | 2.15% |

| SLQD | iShares 0-5 Year Investment Grade Corporate Bond ETF | 2.09% |

| IBDQ | iShares iBonds Dec 2025 Term Corporate ETF | 1.90% |

| MEAR | iShares Short Maturity Municipal Bond Active ETF | 1.89% |

| CNYA | iShares MSCI China A ETF | 1.85% |

| SUSB | iShares ESG Aware 1-5 Year USD Corporate Bond ETF | 1.85% |

| IBDS | iShares iBonds Dec 2027 Term Corporate ETF | 1.66% |

| IBDR | iShares iBonds Dec 2026 Term Corporate ETF | 1.57% |

| IBDT | iShares iBonds Dec 2028 Term Corporate ETF | 1.52% |

| ISTB | iShares Core 1-5 Year USD Bond ETF | 1.46% |

| EMB | iShares J.P. Morgan USD Emerging Markets Bond ETF | 1.38% |

| EWH | iShares MSCI Hong Kong ETF | 1.32% |

| TIP | iShares TIPS Bond ETF | 1.26% |

| IBDU | iShares iBonds Dec 2029 Term Corporate ETF | 1.18% |

| BYLD | iShares Yield Optimized Bond ETF | 1.11% |

| SHY | iShares 1-3 Year Treasury Bond ETF | 1.05% |

| SUB | iShares Short-Term National Muni Bond ETF | 1.02% |

| IGIB | iShares 5-10 Year Investment Grade Corporate Bond ETF | 0.98% |

| IGEB | iShares Investment Grade Systematic Bond ETF | 0.91% |

| FXI | iShares China Large-Cap ETF | 0.83% |

| FIBR | iShares U.S. Fixed Income Balanced Risk Systematic ETF | 0.78% |

| LEMB | iShares J.P. Morgan EM Local Currency Bond ETF | 0.69% |

| IBMO | iShares iBonds Dec 2026 Term Muni Bond ETF | 0.65% |

| IBMN | iShares iBonds Dec 2025 Term Muni Bond ETF | 0.64% |

| CMBS | iShares CMBS ETF | 0.62% |

| IAGG | iShares Core International Aggregate Bond ETF | 0.57% |

| IBMP | iShares iBonds Dec 2027 Term Muni Bond ETF | 0.52% |

| MUB | iShares National Muni Bond ETF | 0.47% |

| NYF | iShares New York Muni Bond ETF | 0.37% |

| IBMQ | iShares iBonds Dec 2028 Term Muni Bond ETF | 0.33% |

| IBTF | iShares iBonds Dec 2025 Term Treasury ETF | 0.31% |

| USIG | iShares Broad USD Investment Grade Corporate Bond ETF | 0.30% |

| GVI | iShares Intermediate Government/Credit Bond ETF | 0.29% |

| AGZ | iShares Agency Bond ETF | 0.27% |

| ENZL | MSCI New Zealand All Cap Top 25 Capped Index | 0.11% |

| CMF | iShares California Muni Bond ETF | -0.14% |

| ISHG | iShares 1-3 Year International Treasury Bond ETF | -0.18% |

| ECNS | iShares MSCI China Small-Cap ETF | -0.19% |

| BGRN | iShares Trust iShares USD Green Bond ETF | -0.20% |

| SUSC | iShares ESG Aware USD Corporate Bond ETF | -0.24% |

| IBTG | iShares iBonds Dec 2026 Term Treasury ETF | -0.30% |

| MCHI | iShares MSCI China ETF | -0.31% |

| IUSB | iShares Core Total USD Bond Market ETF | -0.46% |

| IMTB | iShares Core 5-10 Year USD Bond ETF | -0.57% |

| IEI | iShares 3-7 Year Treasury Bond ETF | -0.70% |

| LQD | iShares iBoxx $ Investment Grade Corporate Bond ETF | -0.71% |

| IBTH | iShares iBonds Dec 2027 Term Treasury ETF | -0.85% |

| QLTA | iShares Aaa – A Rated Corporate Bond ETF | -0.91% |

| AGG | iShares Core U.S. Aggregate Bond ETF | -1.08% |

| GNMA | iShares GNMA Bond ETF | -1.12% |

| MBB | iShares MBS ETF | -1.21% |

| EAGG | iShares ESG Aware US Aggregate Bond ETF | -1.22% |

| IBTI | iShares iBonds Dec 2028 Term Treasury ETF | -1.28% |

| GBF | iShares Government/Credit Bond ETF | -1.38% |

| IBB | iShares Biotechnology ETF | -1.46% |

| THD | iShares MSCI Thailand ETF | -1.74% |

| IBTJ | iShares iBonds Dec 2029 Term Treasury ETF | -1.74% |

| GOVT | iShares U.S. Treasury Bond ETF | -2.04% |

| IGLB | iShares 10+ Year Investment Grade Corporate Bond ETF | -2.52% |

| IEF | iShares 7-10 Year Treasury Bond ETF | -2.98% |

| IGOV | iShares International Treasury Bond ETF | -3.55% |

| ILTB | iShares Core 10+ Year USD Bond ETF | -4.64% |

| TLH | iShares 10-20 Year Treasury Bond ETF | -7.42% |

| TLT | iShares 20+ Year Treasury Bond ETF | -10.09% |

| IDNA | iShares Genomics Immunology and Healthcare ETF | -10.53% |

iShares ETF什麼買

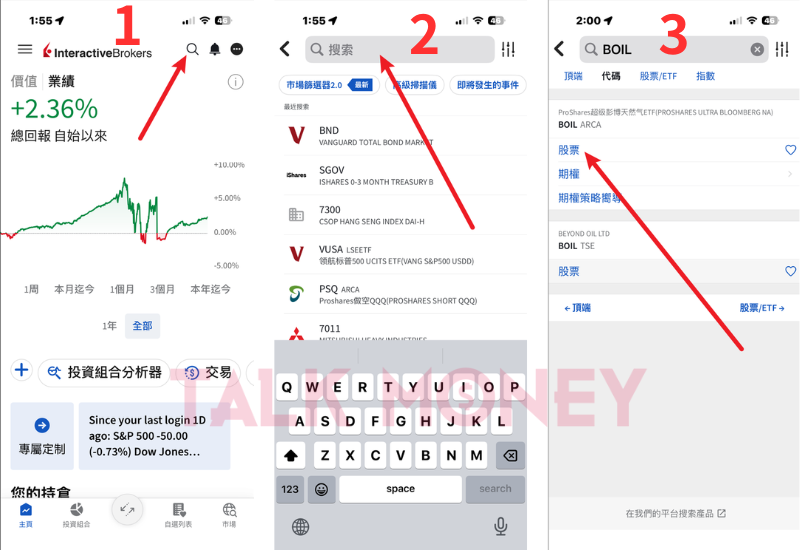

小偏以IB (Interactive Brokers) 盈透證券做示範如何在app購買ETF:

1️⃣點擊圖案進入

2️⃣在搜索位置輸入你想購買的ETF代號

3️⃣看到你想購買的ETF代號後,點擊股票位置

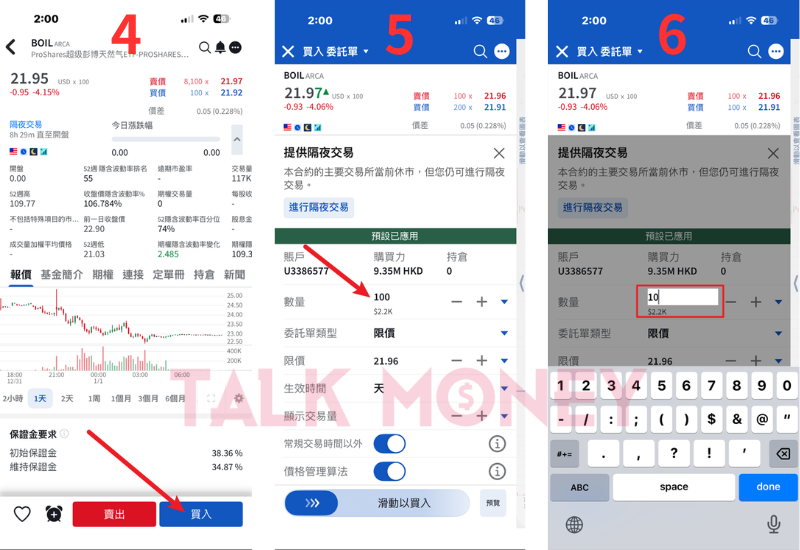

4️⃣點擊購買

5️⃣點擊數量

6️⃣輸入你想購買的數量

7️⃣點擊預覽

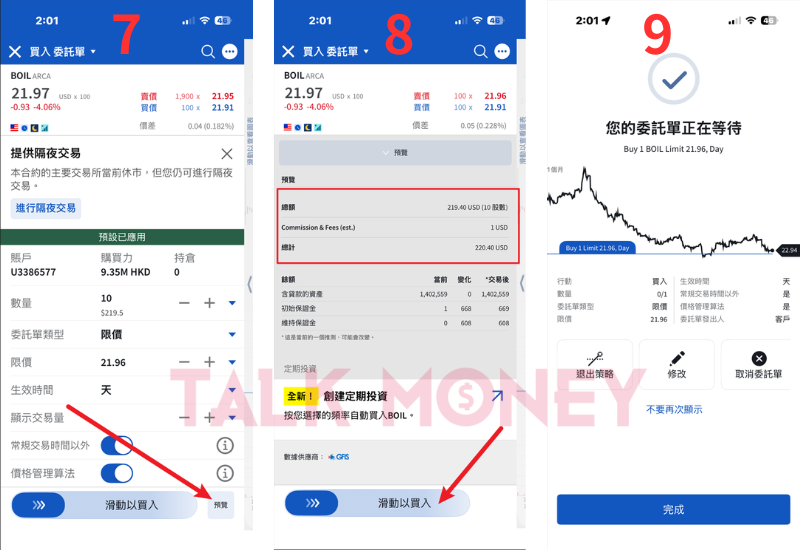

8️⃣確認總額和傭金無誤後,滑動位置買入

9️⃣顯示成功下單,IB (Interactive Brokers) 購買

在香港購買 iShares ETF 與買賣一般股票的流程非常相似。您需要在香港的證券行開立一個證券交易賬戶。在下單前,務必確認您想購買的 iShares ETF 是在哪個市場上市,以及其交易代號和交易貨幣。

| 證券商 | 買賣iShares ETF開戶優惠 |

| 老虎證券 | 【了解最新獨家開戶優惠】 |

| 富途牛牛 | 【了解最新獨家開戶優惠】 |

| 盈透證券 | 【了解最新獨家開戶優惠】 |

| 華盛證券 | 【了解最新獨家開戶優惠】 |

| 長橋證券 | 【了解最新獨家開戶優惠】 |

| 漲樂全球通 | 【了解最新獨家開戶優惠】 |

| uSMART 盈立證券 | 【了解最新獨家開戶優惠】 |

| Webull 微牛證券 | 【了解最新獨家開戶優惠】 |

富途證券

富途證券iShares ETF交易收費表

| iShares ETF交易費用 | 每股$0.0049美元 + 每股US$0.005平台使用費 |

Webull 微牛證券

微牛證券iShares ETF交易收費表

| iShares ETF交易費用 | 每股US$0.0045佣金 + 每股US$0.0045 平台使用費 |

老虎證券

老虎證券iShares ETF交易收費表

| iShares ETF交易費用 | 每股US$0.0039佣金 + 每股US$0.004平台使用費 |

漲樂全球通

漲樂全球通iShares ETF交易收費表

| iShares ETF交易費用 | 每股US$0.0039佣金 + 每股US$0.0039平台使用費 |

華盛證券

華盛證券iShares ETF交易收費表

| iShares ETF交易費用 | 每股US$0.0049佣金 + 每股US$0.005平台使用費 |

IB 盈透證券

盈透證券iShares ETF交易收費表

| iShares ETF交易費用 | 每股US$0.0049佣金 + US$0平台使用費 |

uSMART 盈立證券

盈立證券iShares ETF交易收費表

| iShares ETF交易費用 | 零佣金 + 每股US$0.009平台使用費 |

長橋證券

長橋證券iShares ETF交易收費表

| iShares ETF交易費用 | 零佣金 + 每股US$0.005平台使用費 |

常見問題

❗iShares 安碩是全球最大的資產管理公司貝萊德(BlackRock)旗下的交易所買賣基金(ETF)品牌❗。簡單來說,它提供種類繁多的 ETF 產品,讓投資人能夠以相對低的成本和便利的方式,投資於各式各樣的市場和資產。

在香港購買 iShares ETF 與買賣一般股票的流程非常相似。您需要在香港的證券行開立一個證券交易賬戶。在下單前,務必確認您想購買的 iShares ETF 是在哪個市場上市,以及其交易代號和交易貨幣。